The current bull market that started in March 2009 has been epic. Again and again, at key moments, the market bounced from key support levels. Countless Head & Shoulders Top patterns turned into H&S Top Failures that started yet another run higher. Countless sideways trading became continuation patterns that started the next leg higher. The market survived key tests and thrived.

We seem to be at another key test. Let's first look at 6-year weekly chart of SPY (S&P 500):

A historic run where the market has gained more than 200% in 6 years. Next, let's look at a 3-year weekly chart that shows a possible 3-year trendline support:

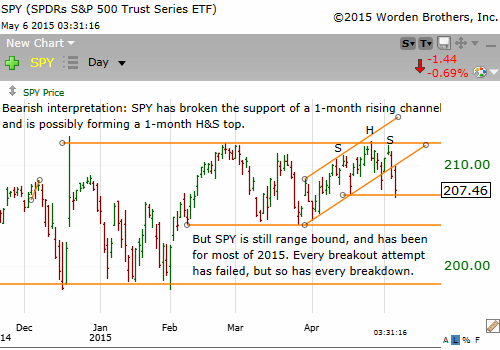

Next, a daily chart focusing on the past 10 months:

Intriguing possibilities. But, stocks have not broken down so far. And they haven't for 6 years. An epic breakdown is possible, but it is only a possibility. And there are good reasons to think that the market will bounce yet again. SPY is resting and finding support at its 200-day moving average. If the 200-day is pierced, then there is likely to be strong support around the 205 level.

So several things have to happen before a breakdown is confirmed. My approach is to stay patient and let the market point the way. There is no need to try to predict. We cannot. Instead, we should let the market declare its intention. We'll likely find a good entry spot even after the fact.

Let's look at IWM (Russell 2000) for comparison. I find the IWM chart the most interesting among the indexes.

First, a 6-year weekly chart:

IWM is up 265% since the financial crisis low. Will it continue higher or is a reversal near? Let's look at a 10-month daily chart:

Next, let's focus on the past 5 months:

Such a pattern within a pattern is always interesting but never guarantees a set-up will work. In fact, the more intriguing the pattern, the more dangerous. Why? Because we get obsessed with the set-up "working" and producing the wished-for outcome rather than trading the actual price action.

So, for now, we should be aware of the potential set-ups. Then we must have the patience and strength to let the market show us the way.