Stocks have been range bound throughout 2015 and especially since February. Now it seems a resolution to this range-bound trading may be at hand:

We see a breakout from a 3-week symmetrical triangle that may push SPY above resistance and possibly launch the next uptrend of this 6-year bull market.

Previously, we discussed possible bearish readings of the SPY chart. These bearish interpretations may still come true. After all, SPY has not yet decisively cleared resistance around the 212 level.

The key is not anticipating or predicting but keeping our minds open and participating with the market trend. My sense is that many traders and investors thought this 3-month congestion would lead, finally, to a meaningful decline. I have also been watching for the long-awaited correction. The decline could still happen. But I will do my best to stay mentally flexible to be able to take advantage of the actual price action.

If we are bearish and positioned accordingly, then we can try exiting our positions, clearing our mind as best as we can, and just waiting for the market to declare its intentions. The same goes for the bulls. If the breakout fails yet again, then we might try not trading until the true trend is revealed.

This blog is about classical chart patterns in stocks. Just because I discuss a chart does not mean I traded it. I will never make trade recommendations, and you should not listen to those who do. We must develop our own style of interpreting and trading chart patterns. Traders have different entry and exit strategies, risk tolerances, and opinions about a chart set-up. Don't worry about what others are doing. Focus on protecting your capital while gaining market experience.

Thursday, May 14, 2015

Wednesday, May 6, 2015

Update: $F breaking down from 3-month range-bound trading

Previously we discussed a possible bullish scenario for Ford. Now Ford is breaking down from a 3-month period of range-bound trading:

Remember, charting is all about possibilities. There are no guarantees in the market except risk. The possible breakdown in progress does not negate a possible longer term bullish scenario. But we must adjust our trading and thinking according to the price action. And the current action shows weakness. We must not solely focus on and wish for the bullish case because that's "supposed" to happen. Trading based on what "should" happen is costly.

Remember, charting is all about possibilities. There are no guarantees in the market except risk. The possible breakdown in progress does not negate a possible longer term bullish scenario. But we must adjust our trading and thinking according to the price action. And the current action shows weakness. We must not solely focus on and wish for the bullish case because that's "supposed" to happen. Trading based on what "should" happen is costly.

Stocks are still range bound, but there are some interesting bearish possibilities

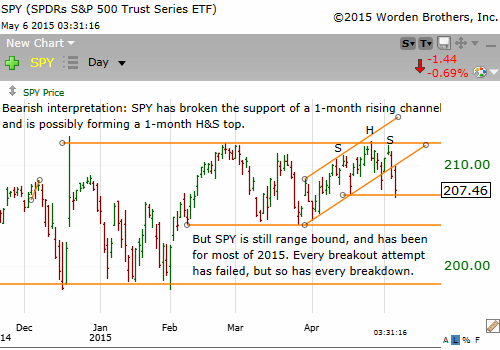

SPY has dropped 2% over 2 days, but it is still range bound :

In fact, we noted previously how SPY has been range bound for most of this year.

If we were to make a case for continued weakness in stocks, then we could point to SPY breaking below support of the rising channel/bear flag. There is also a possible 4-week H&S top forming. That said, such small patterns usually fail and the chart goes onto form something different. Still, traders must remain flexible and be open to different possibilities.

In fact, we noted previously how SPY has been range bound for most of this year.

If we were to make a case for continued weakness in stocks, then we could point to SPY breaking below support of the rising channel/bear flag. There is also a possible 4-week H&S top forming. That said, such small patterns usually fail and the chart goes onto form something different. Still, traders must remain flexible and be open to different possibilities.

Subscribe to:

Posts (Atom)