Stocks have been range bound for 2 years. Now, is there an upside breakout?

Let's look at the QQQ ETF. Here is a 2-year daily chart:

My interpretation of the current situation in the QQQs is strong upside breakout from a 20-month diamond pattern that continues this historic bull market that started in March 2009. One of the most difficult things to accept about this interpretation is that stocks have been on such a historic and powerful run, gaining around 250% since early 2009. Since stocks have gone up so much, could they continue to go up? This diamond interpretation of the price action says yes.

It is so difficult to accept what is in front of us. Of course I could be wrong and this continuation diamond pattern interpretation can fail. You don't have to be persuaded by the diamond interpretation. What you should not do is trade based on what you think stocks "should or "must" do. There is no should or must. There is only what is, and one interpretation of the current situation is a strong breakout from a large continuation pattern. You don't have to agree. You don't have to trade. Sitting on the sidelines is often the most profitable thing to do.

If you want to go short, your opportunity will come. Until then, wait.

This blog is about classical chart patterns in stocks. Just because I discuss a chart does not mean I traded it. I will never make trade recommendations, and you should not listen to those who do. We must develop our own style of interpreting and trading chart patterns. Traders have different entry and exit strategies, risk tolerances, and opinions about a chart set-up. Don't worry about what others are doing. Focus on protecting your capital while gaining market experience.

Sunday, July 31, 2016

Sunday, May 15, 2016

U.S. Stock Market: Where Are We?

Our first chart is a weekly chart of the DIA (ETF that tracks the Dow Jones Industrial Average):

We see a clear Head & Shoulders Top that marked the 2007 peak in stocks.

Since bottoming in early 2009, stocks have been on a historic uptrend. However, things may be changing. A 7-year uptrend line was broken in mid-2015. Since then, stocks have been range bound. In fact, DIA has been range bound since early 2014, with the 152 level providing support and the 183 level being resistance.

The next chart is a weekly chart of DIA focusing on the last four years:

We see even more clearly the breaking of the 7-year uptrend and how stocks have been trading in a range since early 2014. Some people see another historic H&S top forming. Another massive topping pattern is possible. But there is always an alternative possibility. This range-bound trading could be a continuation pattern that continues the previous 7-year uptrend. Anything is possible. Traders must be open to all possibilities.

Let's now look at a daily chart of DIA since early 2015:

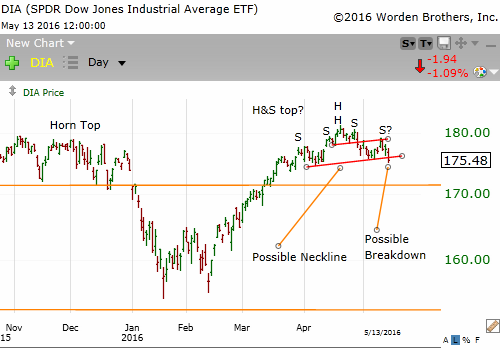

We see a well-defined complex H&S top that led to the sharp drop in August 2015. Then stocks rallied before forming a clean horn top that started the sharp decline in January 2016. Stocks rallied yet again for the last three months. Next is a daily chart focusing on the last 6 months:

I see a possible H&S top where the head itself is a small H&S top. Such a pattern within a pattern is fascinating. It can also give us good trade entry points. As of the market's close last Friday, prices closed below the possible neckline of this 6-week H&S top. Whether there is follow through and this pattern completes or changes into a different pattern and negates the H&S top interpretation remains to be seen. If the H&S top is triggered, then another question is how far stocks could fall.

Remember, be open to all possibilities. This H&S top can quickly change into a H&S top failure that starts yet another uptrend.

If stocks decline to the lows of early 2014, August 2015, and early 2016, then the big question will be whether the 153 level will again provide support or give way to a historic 2.5 year topping pattern. But we are getting ahead of ourselves. Let's first see if our 6-week H&S top interpretation becomes reality.

We see a clear Head & Shoulders Top that marked the 2007 peak in stocks.

Since bottoming in early 2009, stocks have been on a historic uptrend. However, things may be changing. A 7-year uptrend line was broken in mid-2015. Since then, stocks have been range bound. In fact, DIA has been range bound since early 2014, with the 152 level providing support and the 183 level being resistance.

The next chart is a weekly chart of DIA focusing on the last four years:

We see even more clearly the breaking of the 7-year uptrend and how stocks have been trading in a range since early 2014. Some people see another historic H&S top forming. Another massive topping pattern is possible. But there is always an alternative possibility. This range-bound trading could be a continuation pattern that continues the previous 7-year uptrend. Anything is possible. Traders must be open to all possibilities.

Let's now look at a daily chart of DIA since early 2015:

We see a well-defined complex H&S top that led to the sharp drop in August 2015. Then stocks rallied before forming a clean horn top that started the sharp decline in January 2016. Stocks rallied yet again for the last three months. Next is a daily chart focusing on the last 6 months:

I see a possible H&S top where the head itself is a small H&S top. Such a pattern within a pattern is fascinating. It can also give us good trade entry points. As of the market's close last Friday, prices closed below the possible neckline of this 6-week H&S top. Whether there is follow through and this pattern completes or changes into a different pattern and negates the H&S top interpretation remains to be seen. If the H&S top is triggered, then another question is how far stocks could fall.

Remember, be open to all possibilities. This H&S top can quickly change into a H&S top failure that starts yet another uptrend.

If stocks decline to the lows of early 2014, August 2015, and early 2016, then the big question will be whether the 153 level will again provide support or give way to a historic 2.5 year topping pattern. But we are getting ahead of ourselves. Let's first see if our 6-week H&S top interpretation becomes reality.

Thursday, February 4, 2016

Gold, Silver, and Miners going higher?

As we noted, US stock indexes may be forming big topping patterns. Today, we'll look at whether gold and silver miners may be breaking out from a significant bottom.

The following chart is a daily chart of GDX (gold miners ETF):

GDX traded above $66 in 2011. By mid-2015, it was at $13. At the beginning of 2016, it seemed poised for another big decline as it formed a classic continuation H&S top. The breakdown on January 19 was decisive. But in the last 2 weeks GDX made a U-turn and has now closed decisively above the right shoulder high of the continuation H&S top. Now we have a false breakdown and a H&S top failure, which I learned from Peter L. Brandt is a separate pattern that can produce big moves. Of course every pattern can fail. And I expect much volatility in the weeks and months ahead. But if GDX builds a base above the $15 level and make sustained moves higher, then we may have a significant reversal in the precious metals and mining sector.

Please remember to stay patient. There will always be other trades.

The following chart is a daily chart of GDX (gold miners ETF):

GDX traded above $66 in 2011. By mid-2015, it was at $13. At the beginning of 2016, it seemed poised for another big decline as it formed a classic continuation H&S top. The breakdown on January 19 was decisive. But in the last 2 weeks GDX made a U-turn and has now closed decisively above the right shoulder high of the continuation H&S top. Now we have a false breakdown and a H&S top failure, which I learned from Peter L. Brandt is a separate pattern that can produce big moves. Of course every pattern can fail. And I expect much volatility in the weeks and months ahead. But if GDX builds a base above the $15 level and make sustained moves higher, then we may have a significant reversal in the precious metals and mining sector.

Please remember to stay patient. There will always be other trades.

Sunday, January 31, 2016

State of the US equity market

Let's get to it. Today's first chart is the weekly chart of the NYSE index:

I see a possible massive Head & Shoulders top forming in the major U.S. equity indexes. Does this mean that a 25%, 40%, 50%, or even larger drop in stocks is inevitable? No, charts do not predict, let alone guarantee, financial or economic developments. Charts - and our interpretation of them - only inform us of possibilities. It is possible for stocks to rally and negate this topping interpretation.

Still, the possibility of a serious drop is real. Remember, recessions happen (and it seems we always know only in hindsight), and stocks drop quite a bit during an average recession. If we experience a more serious global financial trauma, then a 50% or even 60% or greater decline is possible. Stocks lost 90% of their value during the Great Depression. Anything is possible. We can only try to control our emotions and limit our risk as traders.

The next chart is a daily NYSE chart for a closer view of the set-up:

After declining more than 10% from late December, stocks have rebounded in the last 2 weeks and seem to be in the middle of a rally. Nobody knows how much higher this rally will go.

As noted, we can only control our entries, exits, and risk. Positioning and staying patient are vital. We can be "right" about the market and lose money. Say that we expected the market to break down. If we shorted heavily after the indexes broke below the neckline, then we may be surprised and dismayed by the market's recent rally. And such panic is understandable. After all, the market may continue to rally for weeks or even months as it not only negates the H&S top but also starts another uptrend. Nobody knows. So positioning is vital. If we have not shorted yet, then the current rally (if it continues) may give us a chance to short at a spot (higher) that better controls our risk.

If we piled into short positions just before the market rallied, then covering them may be appropriate. If the market resumes its downturn, then we'll have conserved enough financial and mental capital to re-short at an appropriate place. If the market continues higher, then we'll also have conserved our capital as we wait to see a potential inflection point before the market turns down again.

Remember to stay flexible. If the market doesn't decline but instead starts an uptrend, then we can trade accordingly. Or not. No one forces us to be in the market. Don't trade if you don't want to trade. The key is preserving our capital so we have a choice.

There are no certainties in trading except risk. Always remember that there will always be more set-ups to trade.

I see a possible massive Head & Shoulders top forming in the major U.S. equity indexes. Does this mean that a 25%, 40%, 50%, or even larger drop in stocks is inevitable? No, charts do not predict, let alone guarantee, financial or economic developments. Charts - and our interpretation of them - only inform us of possibilities. It is possible for stocks to rally and negate this topping interpretation.

Still, the possibility of a serious drop is real. Remember, recessions happen (and it seems we always know only in hindsight), and stocks drop quite a bit during an average recession. If we experience a more serious global financial trauma, then a 50% or even 60% or greater decline is possible. Stocks lost 90% of their value during the Great Depression. Anything is possible. We can only try to control our emotions and limit our risk as traders.

The next chart is a daily NYSE chart for a closer view of the set-up:

After declining more than 10% from late December, stocks have rebounded in the last 2 weeks and seem to be in the middle of a rally. Nobody knows how much higher this rally will go.

As noted, we can only control our entries, exits, and risk. Positioning and staying patient are vital. We can be "right" about the market and lose money. Say that we expected the market to break down. If we shorted heavily after the indexes broke below the neckline, then we may be surprised and dismayed by the market's recent rally. And such panic is understandable. After all, the market may continue to rally for weeks or even months as it not only negates the H&S top but also starts another uptrend. Nobody knows. So positioning is vital. If we have not shorted yet, then the current rally (if it continues) may give us a chance to short at a spot (higher) that better controls our risk.

If we piled into short positions just before the market rallied, then covering them may be appropriate. If the market resumes its downturn, then we'll have conserved enough financial and mental capital to re-short at an appropriate place. If the market continues higher, then we'll also have conserved our capital as we wait to see a potential inflection point before the market turns down again.

Remember to stay flexible. If the market doesn't decline but instead starts an uptrend, then we can trade accordingly. Or not. No one forces us to be in the market. Don't trade if you don't want to trade. The key is preserving our capital so we have a choice.

There are no certainties in trading except risk. Always remember that there will always be more set-ups to trade.

Subscribe to:

Comments (Atom)