As we noted, US stock indexes may be forming big topping patterns. Today, we'll look at whether gold and silver miners may be breaking out from a significant bottom.

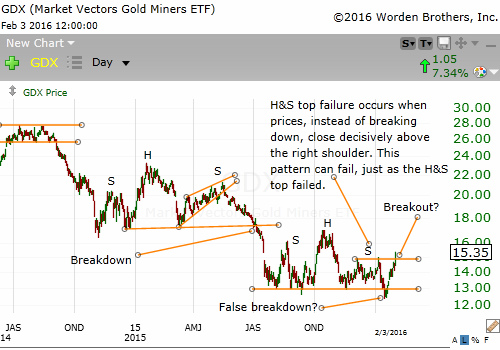

The following chart is a daily chart of GDX (gold miners ETF):

GDX traded above $66 in 2011. By mid-2015, it was at $13. At the beginning of 2016, it seemed poised for another big decline as it formed a classic continuation H&S top. The breakdown on January 19 was decisive. But in the last 2 weeks GDX made a U-turn and has now closed decisively above the right shoulder high of the continuation H&S top. Now we have a false breakdown and a H&S top failure, which I learned from Peter L. Brandt is a separate pattern that can produce big moves. Of course every pattern can fail. And I expect much volatility in the weeks and months ahead. But if GDX builds a base above the $15 level and make sustained moves higher, then we may have a significant reversal in the precious metals and mining sector.

Please remember to stay patient. There will always be other trades.