Let's look at the chart of TLT:

TLT broke out of a 6-month channel in August and has been retesting the channel's upper boundary for three weeks. Now, it is trying to break out of a 3-week channel.

In my chart trading mode, I don't make macroeconomic predictions or engage in economic analysis. Instead, I follow the price. Still, it is fun to think about the implications of particular price moves. If stocks struggle while long bonds shoot higher, we might suspect that the economy is slowing and/or investors and traders fear deflation. Then of course there is what the Federal Reserve may do in response to low inflation expectations (QE 4?) and the Fed's effect on stocks, bonds, and commodities.

Or, we can just follow the price.

This blog is about classical chart patterns in stocks. Just because I discuss a chart does not mean I traded it. I will never make trade recommendations, and you should not listen to those who do. We must develop our own style of interpreting and trading chart patterns. Traders have different entry and exit strategies, risk tolerances, and opinions about a chart set-up. Don't worry about what others are doing. Focus on protecting your capital while gaining market experience.

Friday, September 18, 2015

Thursday, September 17, 2015

UPDATE: S&P 500

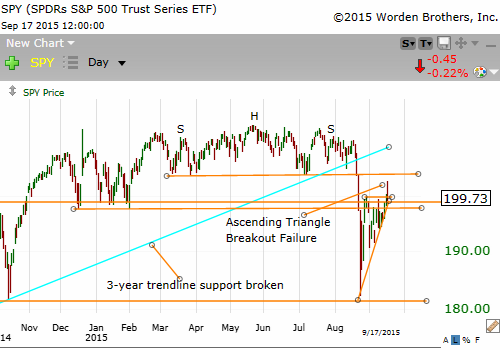

Let's look at the SPY chart:

For three weeks an ascending triangle has been forming. Today SPY broke above the horizontal upper boundary in a seemingly decisive breakout. But by the end of the day prices reversed and closed at a loss: a classic reversal day.

Now what?

First, the strong reversal was not so surprising. After all, there is strong resistance in the 200 to 203 level.

Second, today's reversal does not preclude another breakout attempt that may take SPY to new all-time highs.

Third, anything is possible. Patterns can morph and change into something else over a matter of days. The ascending triangle? Over the next several days it may become a bearish rising wedge that produces a decisive breakdown.

All we can do is accept the price action and trade when the reward-to-risk ratio is favorable.

For three weeks an ascending triangle has been forming. Today SPY broke above the horizontal upper boundary in a seemingly decisive breakout. But by the end of the day prices reversed and closed at a loss: a classic reversal day.

Now what?

First, the strong reversal was not so surprising. After all, there is strong resistance in the 200 to 203 level.

Second, today's reversal does not preclude another breakout attempt that may take SPY to new all-time highs.

Third, anything is possible. Patterns can morph and change into something else over a matter of days. The ascending triangle? Over the next several days it may become a bearish rising wedge that produces a decisive breakdown.

All we can do is accept the price action and trade when the reward-to-risk ratio is favorable.

Wednesday, September 9, 2015

Analysis of U.S. stock indexes

Last month, we discussed possible topping patterns in U.S. stock indexes and individual stocks. Let's see what the charts have done in the two weeks since the start of heightened volatility.

Let's look at the SPY (S&P 500) chart:

We see a dramatic breakdown from a 6-month H&S top. Prices rebounded from the October 2014 low and have been coiling in a pennant pattern for 2 weeks.

Today SPY was decisively turned back at the 198-199 resistance (formerly support) level. This rejection does not mean that the current 2-week coiling pattern will become a bear pennant that continues the decline. There are no "musts" and "shoulds" in trading other than the utmost importance of limiting our risk on every trade. The current coiling pattern can launch a move up and retest the 204 level and even beyond. Again, there are no guarantees in the market. Especially this market, which has been an epic bull run since the March 2009 low. We must be open to all possibilities. And it is possible that the market will break down and ultimately become a harsh bear market but only after SPY races back up to 204 or even a new all-time high.

So we must keep our eyes open and accept the price action as it is. If we are short, then we must have a strict stop level at which we cover our shares - no ifs or buts. The same for longs: we must stick to our stop level where we will sell and cut our losses.

Please remember that there will always be more set-ups to trade. Let the price action tell you the market's intention. Prices are coiling now. That means the market can go up or down. If it breaks down, then we might look for an advantageous entry spot for shorting. If it breaks up, then look for a good spot to go long . Or, don't trade. We are not required to trade. Doing nothing is often the most profitable move.

Stay patient. We need psychological experience in the market, and that comes through living through a complete market cycle. Then we have a chance of accepting what we see rather than what we want to see.

Let's look at the SPY (S&P 500) chart:

We see a dramatic breakdown from a 6-month H&S top. Prices rebounded from the October 2014 low and have been coiling in a pennant pattern for 2 weeks.

Today SPY was decisively turned back at the 198-199 resistance (formerly support) level. This rejection does not mean that the current 2-week coiling pattern will become a bear pennant that continues the decline. There are no "musts" and "shoulds" in trading other than the utmost importance of limiting our risk on every trade. The current coiling pattern can launch a move up and retest the 204 level and even beyond. Again, there are no guarantees in the market. Especially this market, which has been an epic bull run since the March 2009 low. We must be open to all possibilities. And it is possible that the market will break down and ultimately become a harsh bear market but only after SPY races back up to 204 or even a new all-time high.

So we must keep our eyes open and accept the price action as it is. If we are short, then we must have a strict stop level at which we cover our shares - no ifs or buts. The same for longs: we must stick to our stop level where we will sell and cut our losses.

Please remember that there will always be more set-ups to trade. Let the price action tell you the market's intention. Prices are coiling now. That means the market can go up or down. If it breaks down, then we might look for an advantageous entry spot for shorting. If it breaks up, then look for a good spot to go long . Or, don't trade. We are not required to trade. Doing nothing is often the most profitable move.

Stay patient. We need psychological experience in the market, and that comes through living through a complete market cycle. Then we have a chance of accepting what we see rather than what we want to see.

Subscribe to:

Posts (Atom)